January 2023Investor Presentation

This presentation contains, or incorporates by reference, not only historical information, but also forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our beliefs, expectations, estimates, projections and illustrations and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “target,” “believe,” “outlook,” “potential,” “continue,” “intend,” “seek,” “plan,” “goals,” “future,” “likely,” “may” and similar expressions or their negative forms, or by references to strategy, plans or intentions. The illustrative examples and statements related to potential returns on our common stock included herein are forward-looking statements. By their nature, forward-looking statements speak only as of the date they are made, are not statements of historical facts or guarantees of future performance and are subject to risks, uncertainties, assumptions or changes in circumstances that are difficult to predict or quantify, in particular those related to the COVID-19 pandemic, including the ultimate impact of COVID-19 on our business, financial performance and operating results, fluctuations in interest rates and credit spreads, and our ability to realize the benefits of actions taken or to be taken to reposition our balance sheet. Our expectations, beliefs and estimates are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management's expectations, beliefs and estimates will prove to be correct or be achieved, and actual results may vary materially from what is expressed in or indicated by the forward-looking statements. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2021, and any subsequent Form 10-Q or other filings made with the SEC, under the caption “Risk Factors.” These risks may also be further heightened by the continued and evolving impact of the COVID-19 pandemic and the evolving interest rate environment. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise any such forward-looking statements, whether as a result of new information, future events or otherwise. This presentation is for informational purposes only and shall not constitute, or form a part of, an offer to sell or buy or the solicitation of an offer to sell or the solicitation of an offer to buy any securities. 2 Safe Harbor Statement

3 Cautionary Statement Regarding Endnotes You are encouraged to carefully read the endnotes that are a part of this presentation and start on slide 34 hereto. The endnotes include important information, including details regarding the assumptions we utilize to prepare the illustrative examples contained herein. Such illustrative examples are not a guarantee of future performance and should not be considered financial guidance. The endnotes also point out that certain of the statements contained herein are subject to a number of assumptions and other factors, many of which are beyond the Company's control, and that actual results may differ from the statements contained herein, and such differences may be material. The endnotes also help the reader identify certain forward- looking statements and provide further detail about certain of the statements contained herein, including some of the non-GAAP metrics.

Company Overview

• An internally-managed commercial real estate finance company operating as a REIT, that is focused on originating and investing in floating-rate, first mortgage loans secured by institutional-quality transitional properties. • Investment objective emphasizes preservation of capital while generating attractive risk-adjusted returns over the long-term, primarily through dividends derived from current income produced by the loan portfolio. • $3.9 billion** defensively-positioned nationwide investment portfolio that is diversified across property types, geographies and sponsors. • Solution-driven senior investment team with deep industry relationships and decades of real estate lending experience across economic, credit and interest rate cycles. • Conservatively managed balance sheet with a well-balanced funding profile, moderate leverage and $1 billion of equity capital. • GPMT is a member of the S&P 600 Small Cap index. 5 * Except as otherwise indicated in this presentation, reported data is as of, or for the period ended, September 30, 2022. ** Includes maximum loan commitments. Outstanding principal balance of $3.6 billion. Company Overview*

• Originate high quality floating-rate first mortgage loans on transitional U.S. commercial real estate. • Long-term, fundamental value-oriented philosophy. • Heavy focus on relative value; highly selective and emphasizing broad diversification. • Well-respected lending platform and a well-established, repeat CRE CLO issuer. • Broadly-diversified capitalization profile with moderate leverage. • Long-standing lender relationships. BALANCE SH E E T OVE RV IE WSTR ATE GY OVE RV IE W Loan Yield: 5.6% Cost of Funds: 4.9% Investment Portfolio†† Capitalization * Includes maximum loan commitments. Outstanding principal balance of $3.6 billion. ** See definition in the appendix. † As of December 31, 2022. †† Includes mixed-use properties. 6 $3.9 billion* Portfolio of 97 Loan Investments 100% Loans 99% Senior Loans 98% Floating Rate $37 million Average UPB 1.3x Recourse Debt-to- Equity Leverage 63.2% Weighted Average LTV** ~58% Non-Mark-to- Market Borrowings 2.6x Total Debt-to-Equity Leverage** $3.4 billion Financing Capacity $2.5B Outstanding $132 million† Cash Balance 5.6% Weighted Average Yield Corporate Snapshot Office, 42.6% Multifamily, 29.7% Hotel, 10.1% Retail, 9.9% Industrial, 5.2% Other, 2.5% CLOs Repurchase Facilities Senior Convertible Notes Asset Specific

Investment Highlights 7 EXPERIENCED AND CYCLE-TESTED SENIOR CRE TEAM ▪ Each senior investment team member has over 20 years of experience in the commercial real estate debt markets: including extensive backgrounds in investment management and structured finance. ▪ Broad and long-standing direct relationships within the commercial real estate lending market. ATTRACTIVE AND SUSTAINABLE MARKET OPPORTUNITY ▪ The U.S. CRE lending markets have and are expected over time to offer an enduring opportunity for non-bank specialty finance companies, which are anticipated to continue to gain market share over the long-term. ▪ Senior floating-rate loans remain an attractive value proposition. DIFFERENTIATED DIRECT ORIGINATION PLATFORM ▪ Nationwide lending program targeting income-producing, institutional-quality properties and high quality, experienced sponsors across the top institutional markets. ▪ Geographic diversification helps mitigate concentrated event risk. ▪ Fundamental, value-driven investing, combined with credit intensive underwriting and focus on cash flow, as key underwriting criteria. HIGH CREDIT QUALITY INVESTMENT PORTFOLIO ▪ Portfolio with total loan commitments of $3.9 billion*, a weighted average stabilized LTV of 63.2%** and weighted average all-in yield at origination of LIBOR/SOFR 4.07%.** ▪ 100% loan portfolio well-diversified across property types, geographies and sponsors. DIVERSIFIED FINANCING PROFILE ▪ Moderate balance sheet leverage and a diversified funding mix including CLO securitizations, senior secured credit facilities, asset-specific financings, and senior unsecured convertible notes. ▪ Emphasis on term-matched, non-recourse and non-mark-to-market types of financing such as CLO securitizations and other types of funding facilities. * Includes maximum loan commitments. Outstanding principal balance of $3.6 billion. ** See definition in the appendix.

Experienced and Cycle-Tested Senior Leadership 8 JACK TAYLOR PRESIDENT AND CHIEF EXECUTIVE OFFICER • Previous experience: Head of Global Real Estate Finance, Prudential Real Estate Investors; earlier built and led real estate finance businesses at: Kidder, Peabody; PaineWebber; UBS; and Five Mile Capital Partners • Holds a J.D. from Yale Law School, a MSc. in international relations from LSE and a B.A. in philosophy from the University of Illinois 25+ YEARS OF EXPERIENCE STEPHEN ALPART CHIEF INVESTMENT OFFICER, CO-HEAD OF ORIGINATIONS • Previous experience: Managing Director, Prudential Real Estate Investors; over 25 years of real estate finance, debt investing and workout/restructuring experience at GMACCM/Capmark, UBS/PaineWebber and E&Y Kenneth Leventhal • Holds a M.B.A. in Finance & Real Estate from NYU and a B.S. in Business Administration, Accounting and Economics from Washington University 25+ 25+ 25+ 20+ STEVEN PLUST CHIEF OPERATING OFFICER • Previous experience: Managing Director, Prudential Real Estate Investors; over 25 years of real estate finance and capital markets experience at Kidder, Peabody; PaineWebber; UBS; and Five Mile Capital Partners • Holds a M.B.A. from Columbia University and a B.S. in Chemistry from Rensselaer Polytechnic Institute PETER MORRAL CHIEF DEVELOPMENT OFFICER, CO-HEAD OF ORIGINATIONS • Previous experience: Over 25 years of CRE debt experience with senior positions in origination, capital markets, credit, distribution, and investing in various capacities at: Annaly, UBS, Wachovia, and Bank of America • Holds a M.B.A. from the Ohio State University and a B.L.A. in History from the University of Connecticut MARCIN URBASZEK, CFA ® CHIEF FINANCIAL OFFICER • Previous experience: Financial Institutions investment banking at Credit Suisse, U.S. Banks Equity Research at Citigroup, Equity-linked Capital Markets at JPMorgan • Holds a B.B.A. in Finance, from Zicklin School of Business, Baruch College, CUNY; CFA® Charterholder

Seasoned and Cohesive Team with Top-Tier Multidisciplinary Expertise 9 DECADES OF BROAD EXPERIENCE SUCCESSFULLY NAVIGATING MANY ECONOMIC AND MARKET CYCLES ✓ Decades of balance sheet lending experience managing unlevered and levered portfolios of CRE debt investments and serving as a fiduciary for third party investor capital ✓ Successfully and profitably navigated multiple economic, real estate and capital markets cycles, benefiting from credit discipline as well as extensive asset management and workout experience ✓ Developed a CRE debt platform within a public mortgage REIT; executed an IPO/Spin-off of GPMT and successfully raised additional growth capital ✓ Established GPMT as a leading balance sheet CRE lender with long-standing borrower, property owner and broker relationships driving significant volume of directly originated attractive investment opportunities ✓ GPMT has a well-balanced funding profile, is a large and repeat CRE CLO issuer, and has access to multiple financing sources ✓ Internally-managed structure with a fully staffed, cross functional team with multidisciplinary experience provides many benefits and positions the company well for accretive growth and realization of economies of scale Real Estate Finance Credit Risk Underwriting Direct Loan Origination Asset Finance & Capital Markets Ratings Agency Asset Mgmt., Loan Workouts & REO Private Credit & Equity CMBS Conduit & Loan Securitization Legal & Corporate Governance Human Resources Strategy & Corporate Finance Audit, Tax & Corporate Treasury MULTIDISCIPLINARY EXPERTISE

Investment Strategy and Origination Platform

$100 million GPMT Senior Loan $65 million 100% 65% 48.75% GPMT Equity Investment $16.25 million Financing Facility Advance $48.75 million Borrower’s Equity $35 million LTV Investment Strategy Targeting Senior Loans 11 I LLUSTR AT IVE PROPE RT Y CAP ITAL STRUCTUR E FLOATING RATE FIRST MORTGAGE LOANS PROVIDE EXPOSURE TO COMMERCIAL REAL ESTATE SECTOR AT AN ATTRACTIVE POSITION WITHIN A PROPERTY'S CAPITAL STRUCTURE • Our senior loans are senior to a property owner’s significant equity investment. • The borrower’s equity investment usually provides a credit support cushion of 25-35% of a property’s value. • Focused approach to direct originations and intensive credit underwriting creates attractive first mortgage loan investments with downside protection. • Prioritizing lending on income producing, institutional- quality properties produces cash flow coverage for our loans and generates attractive risk-adjusted returns on our investments.

* See definition in the appendix Target Investments and Portfolio Construction 12 KEY TENETS OF STRATEGY PORTFOLIO CONSTRUCTION ✓ Long-term, fundamental, value-driven philosophy avoiding “sector bets” and “momentum investments” ✓ Emphasize durable and identifiable cash flow rather than sale value of collateral property by lending on income- producing, institutional-quality real estate ✓ Intensive, multifaceted credit diligence through bottom-up underwriting and prioritizing high-quality, well-capitalized and experienced sponsors ✓ Thoughtfully structured loans that provide downside protection; the property is the collateral, but the loan is the investment ✓ Active balance sheet and liquidity management; moderate leverage and maintaining access to a diverse set of funding sources while prioritizing stability of non-mark-to- market financing ✓ Nationwide portfolio constructed on a loan-by-loan basis emphasizing diversification by property type, market and sponsorship ✓ Floating rate first mortgage loans secured by income- producing U.S. commercial real estate ✓ Loans of $20 million to $150 million secured by a variety of asset types (primarily multifamily, office, warehouse/industrial, self-storage, and others) ✓ Transitional properties located in the top institutional markets across the U.S. with strong economic, demographic and real estate fundamentals ✓ Stabilized LTVs* generally ranging from 55% to 70% ✓ Generally target loan yields of SOFR + 3.0% to 5.0%+ ✓ Sponsorship, business plan and loan terms are key considerations in addition to the quality of property collateral, demographics and geographic location THE COMPANY HAS A SUCCESSFUL INVESTMENT PHILOSOPHY THAT HAS BEEN TESTED THROUGH MULTIPLE ECONOMIC, INTEREST RATE AND REAL ESTATE CYCLES

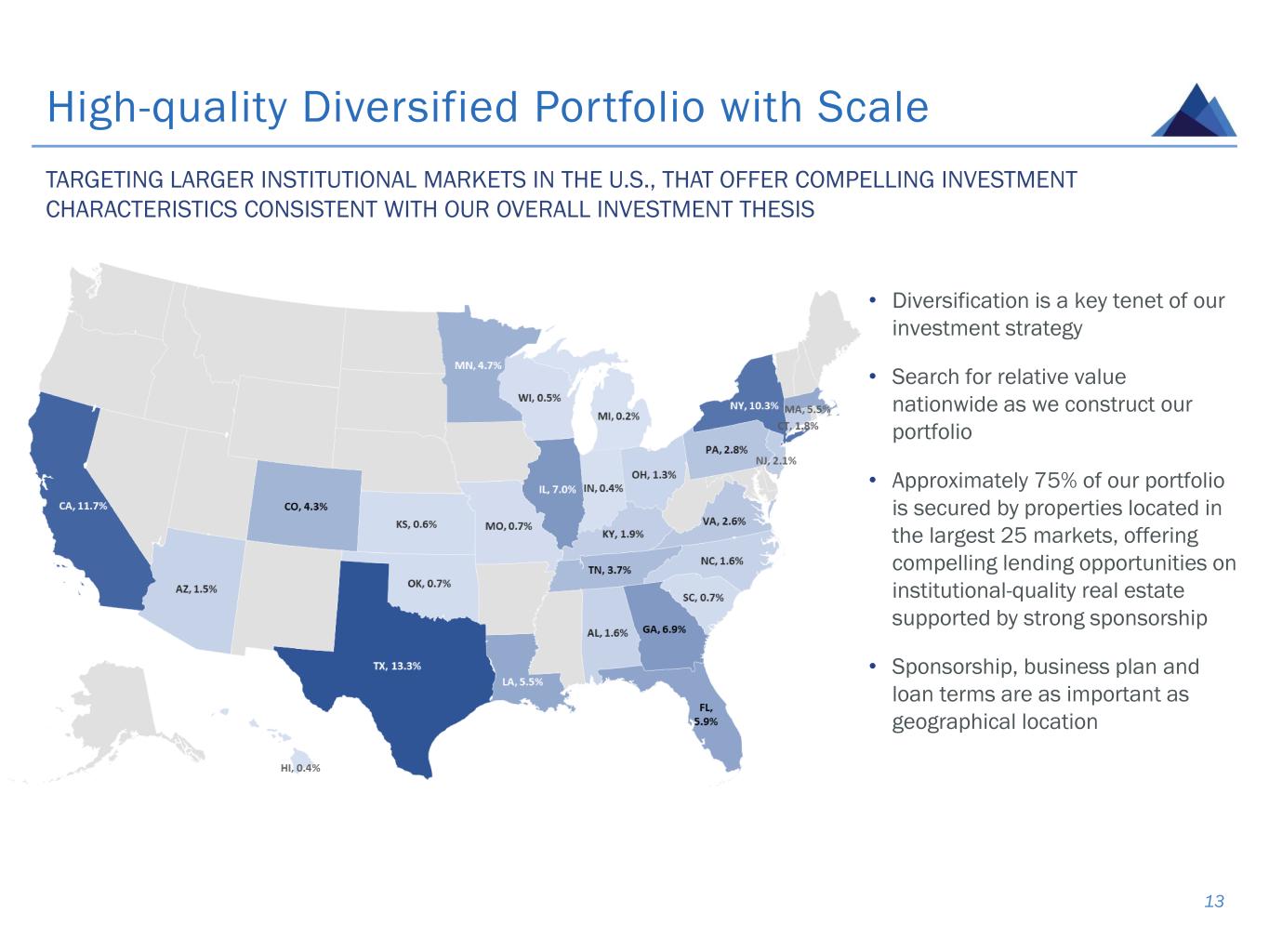

High-quality Diversified Portfolio with Scale 13 • Diversification is a key tenet of our investment strategy • Search for relative value nationwide as we construct our portfolio • Approximately 75% of our portfolio is secured by properties located in the largest 25 markets, offering compelling lending opportunities on institutional-quality real estate supported by strong sponsorship • Sponsorship, business plan and loan terms are as important as geographical location TARGETING LARGER INSTITUTIONAL MARKETS IN THE U.S., THAT OFFER COMPELLING INVESTMENT CHARACTERISTICS CONSISTENT WITH OUR OVERALL INVESTMENT THESIS

Relationships •Directly sourcing a large volume of investment opportunities through established relationships, high-integrity reputation and extensive market knowledge and experience •Originating loans often involves multiple counterparties, including both operators and mortgage brokers, and established relationships with multiple touch points help drive transaction volume Process •Employ a highly-disciplined sourcing, screening and underwriting process focused on resource efficiency, to identify the best investment opportunities and provide reliable, timely and creative solutions to borrower counterparties •The origination process is combined with the financing and capital markets function, driving an efficient feedback loop during underwriting and structuring Results •Many lending opportunities are time of the essence, creating a need for reliability and reputation for acting in good faith, which offers a means of differentiation and drives repeat business •Since inception in 2015, the team has sourced and evaluated tens of billions of dollars of opportunities, while closing on over $6 billion of loan investments Direct Origination Platform Supported by Strong Reputation and Longstanding Relationships DIFFERENTIATED ORIGINATION STRATEGY TARGETING HIGH-QUALITY LOANS ON INSTITUTIONAL-QUALITY PROPERTIES ACROSS ATTRACTIVE MARKETS WITH WELL-CAPITALIZED AND EXPERIENCED SPONSORS • Borrowers range from large private equity firms and national operators to regional and local owners/operators with extensive market and property-type expertise • Team of 7 seasoned originators with an average of over 15 years of experience and longstanding relationships with various market participants 14

Rigorous and Highly Selective Investment Process 15 Billions of dollars of investment opportunities annually are sourced and reviewed. For every 100 transactions we source and review, on average, we do a deeper review on approximately 25% of them … … and historically, we close and fund 2-3% of the opportunities we review. ✓ Deep relationships ✓ Reputation as a high-integrity partner providing certainty of and speed of execution ✓ Solution driven ideas and flexibility to accommodate property business plans H OW WE D IF F E R E NT IATE OUR SE LVE S PE Firms Funds REITs Owners / Operators Brokers Co-Lenders MULT IPLE SOURCING CH ANNE LS Credibility, solution driven ideas, reliability and reputation drive repeat business and the Company’s success as a direct origination platform. ORIGINATION APPROACH PRODUCES A LARGE UNIVERSE OF OPPORTUNITIES FROM WHICH THE MOST ATTRACTIVE INVESTMENTS ARE SELECTED FOR OUR PORTFOLIO

Credit Culture Based on Key Principles 16 • Portfolio construction on a loan-by-loan basis with each investment standing on its own merits and adhering to our overall credit culture • Significant amount of resources are committed upfront to ensure comprehensive underwriting and structuring • Team originating a loan remains responsible for monitoring and managing that investment until capital is repaid Rigorous Underwriting ▪ Property ▪ Markets ▪ Sponsor ▪ Business plan Structuring ▪ Legal document diligence ▪ Loan structure ▪ Lender rights Asset Management ▪ Accountability for loan performance ▪ Proactive monitoring ▪ Borrower dialogue OUR CREDIT CULTURE HAS BEEN DEVELOPED AND NURTURED OVER OUR SENIOR CRE TEAM’S LONG TENURE IN COMMERCIAL REAL ESTATE DEBT MARKETS

Life Cycle of a Loan Investment ORIGINATIONS AND OPERATIONS PROCESS INVOLVES CONTINUOUS COMMUNICATIONS ACROSS THE COMPANY FROM DEAL SOURCING THROUGH ASSET MANAGEMENT 17 Sourcing Underwriting Closing Financing Ongoing Asset Management • Broad industry relationships with a variety of market participants • Multiple touch points on a given transaction • Daily meetings to review pipeline or screen potential opportunities • Members of the Investment Committee get involved early • Underwriting is done in-house and focused on collateral and sponsor analysis, business plan review and exit strategy • Engage third party appraisers, engineers and other consultants • Visit each property / local market before closing • Negotiate term sheet detailing key investment terms • Engage select group of experienced law firms to help negotiate loan documents • Closely coordinate internally on financing, treasury, tax, legal, accounting and other areas • Diversified sources of loan-level financing • Multiple financing facilities with large financial institutions • CRE CLOs • Structured financings • Originators are also asset managers • While we contract with third party servicers to administer the loans, the deal teams retain key decision making authority on major property items (budgets, lease approvals, etc.) Members of the Investment Committee involved throughout

Coordinated and Comprehensive Approach to Asset Management 18 ORIGINATION TEAM THAT SOURCES A LOAN REMAINS RESPONSIBLE FOR ASSET MANAGING IT THROUGHOUT ITS LIFECYCLE UNTIL REPAYMENT • 5-point loan risk rating system • Deal teams retain key decision-making authority on asset management (budgets, lease approvals, monitoring, tracking business plan, etc.) – Frequent communication and feedback with property owners • While key decision-making authority is held by the Company, third party servicers are used to increase efficiency and leverage internal resources – Longstanding relationship with Trimont Real Estate Advisors – Handpicked team at Trimont of fully-dedicated and experienced asset management and servicing professionals • Asset management provides a key early warning system for credit issues, and in many cases can prevent them from occurring – Monitor to ensure compliance with loan terms – Review draw requests for leases and capital items – Remain proactive when business plans begin to slip • Transitional business plans are by nature organic and are expected to evolve over time – Ongoing proactive asset management is a critical component of risk management and in meeting the ongoing needs of borrowers as their business plans evolve

Portfolio Overview

Northeast, 37.6% West, 19.8% Southwest, 18.8% Southeast, 18.7% Midwest, 6.1% Total Portfolio: $1.8 billion Average Loan Balance: ~$42.8 million Senior Loans: 89.6% Office, 50.8% Multifamily, 17.1% Retail, 15.9% Industrial, 9.3% Hotel, 6.9% Investment Portfolio Diversification 20 At IPO September 30, 2022 G e o g ra p h y Total Portfolio: $3.9 billion* Average Loan Balance: ~$37.3 million Senior Loans: 99.6% P ro p e rt y Ty p e December 31, 2019 Total Portfolio: $5.0 billion Average Loan Balance: ~$35.1 million Senior Loans: 98.7% Northeast, 28.5% Southwest, 21.7%West, 17.3% Midwest, 16.8% Southeast, 15.7% Office, 42.5% Multifamily, 24.9% Hotel, 15.0% Retail, 9.4% Industrial, 7.3% Other, 0.9% PORTFOLIO DIVERSIFICATION IS A KEY TENET OF OUR INVESTMENT AND RISK MANAGEMENT STRATEGY * Includes maximum loan commitments. Outstanding principal balance of $3.6 billion. Northeast, 25.4% Southwest, 21.2% Southeast, 20.5% Midwest, 17.0% West, 15.9% Office, 42.6% Multifamily, 29.7% Hotel, 10.1% Retail, 9.9% Industrial, 5.2% Other, 2.5%

$3,889 $3,615 $- $1,000 $2,000 $3,000 $4,000 $5,000 6/30/2022 3Q 2022 Fundings 3Q 2022 Prepayments, Paydowns & Amortization 9/30/2022 $ I n M il li o n s $72 PORTFOLIO ACTIVITY(2) Third Quarter 2022 Portfolio Activity 21 * See definition in the appendix. ** See definition of “All-in Yield at Origination” in the appendix. PAYOFFS BY PROPERTY TYPE $(346) $3,928 $313 Total maximum commitments Future funding commitments PAYOFFS BY GEOGRAPHY • Total funding activity of $72.4 million(1): – Closed one $45.0 million with total commitment and funded $43.4 million in UPB. • Stabilized LTV of 68.2%* and yield of SOFR + 4.25%** – Funded $28.4 million of existing loan commitments. • Realized repayments, paydowns and principal amortization of $346.7 million. Office, 41.2% Hotel, 30.6% Multifamily, 28.1% Southwest, 35.7% West, 27.3% Northeast, 25.1% Midwest, 11.8% (1)

10.3% 49.2% 24.5% 6.9% 9.1% 1 2 3 4 5 Investment Portfolio as of September 30, 2022 22 PROPERTY TYPE(3) GEOGRAPHY STABILIZED LTV* RISK RATINGS * See definition in the appendix. KEY PORTFOLIO STATISTICS Outstanding Principal Balance $3.6 billion Total Loan Commitments $3.9 billion Number of Investments 97 Average UPB ~$37.3 mil Weighted Average Yield at Origination* L+/S+ 4.07% Weighted Average Stabilized LTV* 63.2% Weighted Average Fully-Extended Remaining Term(4) 2.3 years High-quality, well-diversified portfolio comprised of over 99% senior loans with a weighted average stabilized LTV at origination of 63.2%.* Office, 42.6% Multifamily, 29.7% Hotel, 10.1% Retail, 9.9% Industrial, 5.2% Other, 2.5% Northeast, 25.4% Southwest, 21.2% Southeast, 20.5% Midwest, 17.0% West, 15.9% 30.4% 29.4% 21.0% 17.2% 2.0% 0 - 60% 60 - 65% 65 - 70% 70 - 75% 75 - 80%

$3,797 $3,615 $- $1,000 $2,000 $3,000 $4,000 $5,000 12/31/2021 Portfolio YTD 2022 Fundings YTD 2022 Prepayments, Paydowns, Amortization & Loan Sale 9/30/2022 $ I n M il li o n s (5) Portfolio Activity YTD Through Third Quarter 2022 23 PORTFOLIO ACTIVITY(2) PAYOFFS BY PROPERTY TYPE $457 $(639) $3,928 $313 Total maximum commitments Future funding commitments Office, 42.1% Multifamily, 34.2% Hotel, 18.6% Industrial, 4.8% Mixed-Use, 0.3% PAYOFFS BY GEOGRAPHY Southwest, 32.2% Northeast, 30.7% West, 18.2% Southeast, 12.2% Midwest, 6.7%

Investment Boston Industrial Arkansas Multifamily Atlanta Industrial Loan Type Floating-Rate Senior Loan Floating-Rate Senior Loan Floating-Rate Senior Loan Investment Date 03/2022 10/2021 10/2021 Collateral 586,590 SF Industrial Property 264 Unit Garden Style Multifamily Property 618,301 SF Industrial Property Location Leominster, MA Jonesboro, AR Atlanta, GA Committed Amount $50 million $32 million $26 million Coupon S + 3.25% L + 3.15% L + 3.15% Stabilized LTV 60.8% 63.1% 64.5% Investment rationale Acquisition with ability to renew anchor tenant or lease to new tenants at higher rental rates. Acquisition with opportunity to increase rents based on strong demographic/economic trends and as pandemic concessions burn-off. Acquisition with strong in-place cash flow supported by a long-term lease. Select Case Studies* 24* For illustrative purposes only.

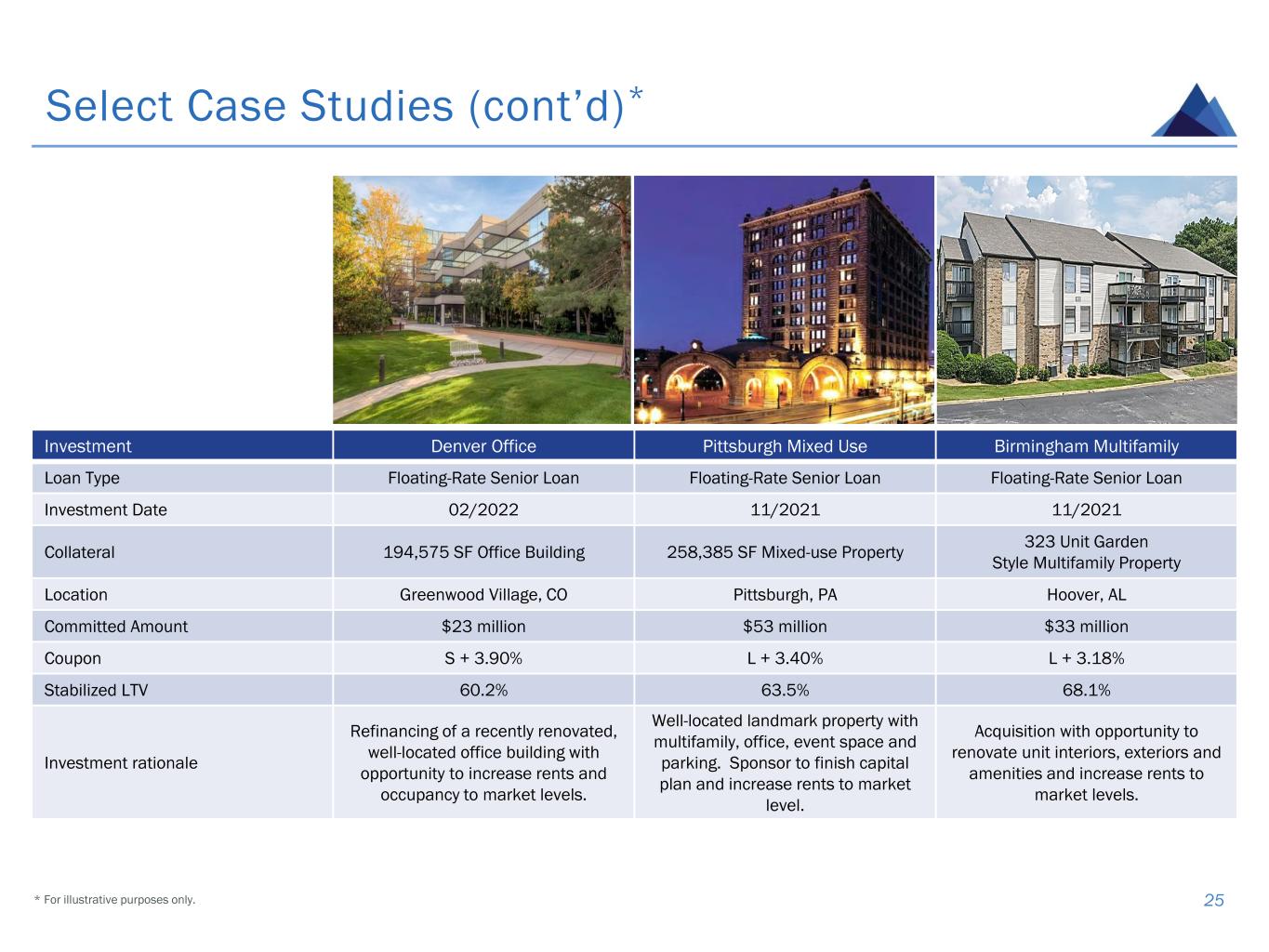

Investment Denver Office Pittsburgh Mixed Use Birmingham Multifamily Loan Type Floating-Rate Senior Loan Floating-Rate Senior Loan Floating-Rate Senior Loan Investment Date 02/2022 11/2021 11/2021 Collateral 194,575 SF Office Building 258,385 SF Mixed-use Property 323 Unit Garden Style Multifamily Property Location Greenwood Village, CO Pittsburgh, PA Hoover, AL Committed Amount $23 million $53 million $33 million Coupon S + 3.90% L + 3.40% L + 3.18% Stabilized LTV 60.2% 63.5% 68.1% Investment rationale Refinancing of a recently renovated, well-located office building with opportunity to increase rents and occupancy to market levels. Well-located landmark property with multifamily, office, event space and parking. Sponsor to finish capital plan and increase rents to market level. Acquisition with opportunity to renovate unit interiors, exteriors and amenities and increase rents to market levels. Select Case Studies (cont’d)* 25* For illustrative purposes only.

Portfolio Developments and “Watch List” Loans 26 San Diego, CA Office(6) Minneapolis, MN Office(7) Louisville, KY Student Housing Phoenix, AZ Office(7) Pasadena, CA Retail(8) Loan Structure Senior floating-rate Senior floating-rate Senior floating-rate Senior floating-rate Senior floating-rate Origination Date October 2019 August 2019 August 2017 May 2017 July 2018 Collateral Property 340k square foot office building 409K square foot office building 271-unit student housing community 255K square foot office building 463k square foot retail center Total Commitment $120 million $93 million $44 million $34 million $114 million Current UPB $93 million $93 million $44 million $30 million $114 million Cash Coupon* L +3.2% L + 2.8% L + 4.2% S + 4.5% L + 3.3% Risk Rating 5 5 4 5 5 * See definition in the appendix. • Over the last several quarters, successfully resolved four nonaccrual loans. Actively pursuing resolution options with respect to the remaining risk-rated “5” loans, which may include a foreclosure, deed-in-lieu, restructuring, a sale of the loan, or a sale of the property. • In October 2022, successfully resolved a $114.1 million senior loan that was on non-accrual status. The resolution involved a coordinated sale of the collateral retail property and GPMT providing new ownership group with a new $77.3 million senior loan supported by fresh equity capital invested in the property by the new sponsor. As a result of these transactions, GPMT expects to realize a loss of approx. $(16.0) million, which had been reserved for through the allowance for credit losses. • Weighted average portfolio risk rating increased to 2.6 as of September 30, 2022. Recently resolved ✓ Sale of Collateral Property

Financial Highlights and Capitalization

Prudent and Proactive Balance Sheet Management 28 GPMT MAINTAINS A CONSERVATIVE FINANCIAL POLICY ✓ Match funding of assets and liabilities to minimize interest-rate risk and maturities ✓ Proven access to diverse sources of public and private debt and equity capital ✓ Emphasis on liability management with meaningful proportion of non-recourse and non-mark-to- market borrowings ✓ Focus on maintaining ample liquidity with approximately $132 million of cash* ✓ Active monitoring of various covenants and leverage ratios when making funding decisions; Target total net debt-to-equity leverage of 3.0x–3.5x ✓ In response to the onset of the COVID-19 pandemic, GPMT management actively managed its balance sheet and improved liquidity position through several prudent measures including reducing borrowings on repurchase facilities and raising strategic financing on attractive terms, among others. * As of December 31, 2022.

Diversification of Funding Sources Over Time 29 CONSERVATIVE MANAGEMENT OF BROADLY DIVERSIFIED FUNDING SOURCES FOCUSED ON NON-MARK-TO- MARKET LIABILITIES • Balance sheet management strategy emphasizes maintaining access to various sources of secured and unsecured funding while focusing on matching the term of assets and liabilities December 31, 2019 September 30, 2022At IPO Total Leverage: ~0.9x Recourse Leverage: ~0.9x Non-MTM*: 0% Total Leverage: ~3.3x Recourse Leverage: ~2.2x Non-MTM*: 42% Total Leverage: ~2.6x Recourse Leverage: ~1.3x Non-MTM*: ~58% Repurchase Facilities Repurchase Facilities CLOs Senior Convertible Notes Asset Specific Revolving Facility * See definition in the appendix. CLOs Repurchase Facilities Senior Convertible Notes Asset Specific

CAPITALIZATION ▪ On December 1, 2022, the Company redeemed the $144 million of Convertible Notes due December 1, 2022, with a cash payment upon maturity. ▪ In December, the Company closed on a new $100 million funding facility providing loan-level financing on a non-mark-to-market basis including for nonperforming loans. The facility matures in December 2025. PORTFOLIO ACTIVITY ▪ Through December 31, 2022, the Company funded approx. $31 million in prior commitments and realized approx. $245 million in loan repayments, paydowns, and one loan sale, of which over 60% have been office loans. ▪ In November, the Company opportunistically sold a $22 million senior loan collateralized by a mixed-use, office and retail, property located in New York. As a result of this transaction, the Company expects to incur a loss on sale of approx. $(1.7) million. ▪ In October, the Company successfully resolved a $114.1 million senior loan that had been on non-accrual status. The resolution involved a coordinated sale of the collateral retail property and GPMT providing the new ownership group with a new $77.3 million senior loan supported by fresh equity capital invested in the property by the new sponsor. As a result of these transactions, GPMT expects to realize a loss of approx. $(16.0) million, which had been reserved for through the allowance for credit losses. LIQUIDITY ▪ As of December 31, 2022, the Company carried approx. $132 million in unrestricted cash. Q4 2022 Business Update 30

FINANCIAL SUMMARY ▪ GAAP net (loss)* of $(29.1) million, or $(0.56) per basic share, inclusive of a $(35.4) million, or $(0.68) per basic share, provision for credit losses. ▪ Distributable Earnings** of $8.7 million, or $0.17 per basic share. ▪ Book value per common share of $15.24, inclusive of $(1.63) per common share CECL reserve. ▪ Common stock dividend per share of $0.25; Series A preferred dividend per share of $0.4375. PORTFOLIO ACTIVITY ▪ Closed one new multifamily loan with total commitment of $45.0 million and funded $72.4 million(1) in total UPB, including prior commitments. ▪ Realized $346.7 million of total UPB in loan repayments, principal paydowns and amortization, which consisted of approximately 41% office, 31% hotel and 28% multifamily loans. PORTFOLIO OVERVIEW ▪ $3.9 billion in total commitments comprised of over 99% senior loans with a weighted average stabilized LTV of 63.2%† and a weighted average yield at origination of L+/S+ 4.07%†; over 98% floating rate. ▪ Weighted average risk rating of 2.6 as of September 30, 2022. ▪ Total CECL reserve of approx. $85.6 million, or 2.18% of total portfolio commitments. CAPITALIZATION & LIQUIDITY ▪ Entered into a new $100 million financing facility providing loan-level funding on a non-mark-to-market basis for performing and non-performing loans. ▪ Ended Q3 with over $165 million in cash on hand, $45 million of restricted cash in CLOs available for reinvestment or repayment of CLO liabilities and a total debt-to-equity leverage of 2.6x. Third Quarter 2022 Highlights 31 * Represents Net Income Attributable to Common Stockholders; see definition in the appendix. ** See definition and reconciliation to GAAP net income in the appendix. † See definition in the appendix.

CLOs Repurchase Facilities Senior Convertible Notes Asset Specific Diversified Capital Sources 32* See definition in the appendix. FINANCING SUMMARY AS OF SEPTEMBER 30, 2022 ($ IN MILLIONS) Total Capacity Outstanding Balance(9) Wtd. Avg Coupon* Advance Rate Non- MTM* Repurchase Facilities(10) $1,898 $1,160 L/S + 2.33% 67.6% Non–MTM* Repurchase Facility $100 $36 S + 5.00% 32.5% CLO-2 (GPMT 2019-FL2) (11) $167 L + 2.45% 49.4% CLO-3 (GPMT 2021-FL3) (11) $558 L + 1.71% 80.2% CLO-4 (GPMT 2021-FL4) (11) $503 L + 1.68% 80.9% Asset-Specific Financing $150 $45 L + 1.70% 77.5% Convertible Notes due Dec. 2022 $144 5.63% — Convertible Notes due Oct. 2023 $132 6.38% — Total Borrowings $2,745 Stockholders’ Equity $1,003.5 FUNDING MIX WELL-DIVERSIFIED CAPITALIZATION PROFILE WITH MODERATE LEVERAGE LEVERAGE* 1.3x 2.6x 0.0x 1.0x 2.0x 3.0x 4.0x 9/30/2022 Recourse Leverage Total Leverage ~58% Non–MTM*

Endnotes

Endnotes 34 1) Includes fundings of prior loan commitments of $28.4 million and capitalized deferred interest of $0.6 million. 2) Data based on principal balance of investments. Due to rounding, individual figures may not add up to the totals presented. 3) Mixed-use properties represented based on allocated loan amounts. 4) Max remaining term assumes all extension options are exercised, if applicable. 5) Includes fundings of prior loan commitments of $106.0 million, one loan upsizing of $6.2 million and capitalized deferred interest of $1.7 million. 6) Loan was placed on nonaccrual status as of June 2022. 7) Loan was placed on nonaccrual status as of September 2022. 8) Loan was placed on nonaccrual status as of June 2021. 9) Outstanding principal balance, excludes deferred debt issuance costs. 10) Includes all repurchase facilities. Includes option to be exercised at the Company’s discretion, subject to customary terms and conditions, to increase the maximum facility amount of the Goldman Sachs facility from $250 million to $350 million. 11) GPMT 2021-FL2, GPMT 2021-FL3 and GPMT 2021-FL4 advance rate includes $3.0 million, $5.5 million and $36.0 million of restricted cash, respectively.

Appendix

SUMMARY INCOME STATEMENT ($ IN MILLIONS, EXCEPT PER SHARE DATA) Net Interest Income $18.3 (Provision) for Credit Losses $(35.4) Operating Expenses $(8.4) Dividends on Preferred Stock $(3.6) GAAP Net (loss)* $(29.1) Basic Wtd. Avg. Common Shares 52,350,989 Diluted Wtd. Avg. Common Shares 52,350,989 Net (loss) Per Basic Share $(0.56) Net (loss) Per Diluted Share $(0.56) Common Dividend Per Share $0.25 Preferred Dividend Per Share $0.4375 Third Quarter 2022 Financial Summary 36* See definition in this appendix. SUMMARY BALANCE SHEET ($ IN MILLIONS, EXCEPT PER SHARE DATA, REFLECTS CARRYING VALUES) Cash $168.4 Restricted Cash $45.2 Loans Held-for-Investment, net $3,520.4 Repurchase Facilities $1,196.0 Securitized (CLO) Debt $1,224.0 Asset-Specific Financing $44.9 Senior Unsecured Convertible Notes $274.3 Preferred Equity $205.7 Common Equity $797.8 Total Stockholders’ Equity $1,003.5 Common Shares Outstanding 52,350,989 Book Value Per Common Share $15.24

$16.01 $15.24 $0.25 $(0.68) $(0.07) $(0.25) $(0.04) $12.00 $13.00 $14.00 $15.00 $16.00 $17.00 6/30/2022 Pre-Provision Earnings (Provision for) Credit Losses Series A Preferred Dividend Declaration Common Stock Dividend Declaration Equity Compensation 9/30/2022 Key Drivers of Third Quarter 2022 Earnings and Book Value Per Share • GAAP Net (loss)* of $(29.1) million, or $(0.56) per basic share, inclusive of a $(35.4) million, or $(0.68) per basic share, provision for credit losses mainly driven by $(30.0) million increase in CECL reserve related to collateral-dependent loans. • Q3 2022 book value per common share of $15.24, inclusive of $(1.63) per common share total CECL reserve. 37 BOOK VALUE WALK * * Due to rounding, individual figures may not add up to the totals presented.

15.5% 19.5% 33.6% 4.4% 17.2% 9.8% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% Pre-2018 2018 2019 2020 2021 2022 % o f P o rt fo li o 1 -M o n th U .S . L IB O R / S O F R % of Floating Rate Loan Portfolio Wtd. Avg. LIBOR/SOFR Floor by Loan Vintage Wtd. Avg. Portfolio LIBOR/SOFR Floor 38 Sensitivity to Short-term Interest Rates QTR. NET INTEREST INCOME PER SHARE SENSITIVITY TO CHANGES IN 1-MO. U.S. LIBOR/SOFR AS OF SEPTEMBER 30, 2022** • Portfolio is over 98% floating rate with a weighted average LIBOR/SOFR floor of 0.94%, meaningfully below current level of short- term benchmark interest rates. • All LIBOR/SOFR floors are currently below the level of market rates. • Well positioned for further increases in short-term interest rates from current market levels. WEIGHTED AVERAGE LIBOR/SOFR FLOOR BY LOAN VINTAGE * $0.02 $0.04 $0.06 $0.07 0.50% 1.00% 1.50% 2.00% Change in 1-Month U.S. LIBOR/SOFR (%) * Reflects changes to LIBOR/SOFR floors arising from loan modifications in prior period. ** Represents estimated change in net interest income for theoretical (+) 50 basis points parallel shifts in 1-month U.S. LIBOR/SOFR, as of 9/30/2022 spot LIBOR and SOFR was 3.14% and 3.04%, respectively. All projected changes in quarterly net interest income are measured as the change from our projected quarterly net interest income based off of current performance returns on portfolio as it existed on September 30, 2022. Actual results of changes in annualized net interest income may differ from the information presented in the sensitivity graph due to differences between the dates of actual interest rate resets in our loan investments and our floating rate interest-bearing liabilities, and the dates as of which the analysis was performed.

Reconciliation of GAAP Net (Loss) Income to Distributable Earnings* 39 ($ IN MILLIONS, EXCEPT PER SHARE DATA) (UNAUDITED) Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 GAAP Net (loss) Income* $18.6 $6.7 $1.0 $(17.4) $(29.1) Adjustments: Provision (Benefit from) for Credit Losses $(5.8) $(5.0) $3.7 $13.6 $35.4 Loss on Extinguishment of Debt $- $8.9 $5.8 $13.0 $- Non-Cash Equity Compensation $2.0 $2.0 $2.2 $1.9 $2.4 Recovery of Amounts Previously Written off $- $- $- $0.5 $- Distributable Earnings* Before Write-off $14.8 $12.7 $12.7 $11.7 $8.7 Write-off on Loan Sale $(9.7) $- $(10.1) $- $- Distributable Earnings* $5.1 $12.7 $2.6 $11.7 $8.7 Basic Wtd. Avg. Common Shares 54,453,546 53,789,465 53,857,051 53,512,005 52,350,989 Diluted Wtd. Avg. Common Shares 56,735,278 54,299,754 53,961,497 53,512,005 52,350,989 Distributable Earnings* Per Basic Share Before Loan Write-off $0.27 $0.24 $0.24 $0.22 $0.17 Distributable Earnings* Per Basic Share $0.09 $0.24 $0.05 $0.22 $0.17 * See definition in this appendix.

($ in thousands) At 9/30/21 At 12/31/21 At 3/31/22 At 6/30/22 At 9/30/22 ASSETS Loans and securities $3,659,691 $3,782,205 $3,784,624 $3,877,294 $3,603,016 Allowance for credit losses $(45,480) $(40,897) $(34,154) $(47,280) $(82,611) Carrying Value $3,614,211 $3,741,308 $3,750,470 $3,830,014 $3,520,405 LIABILITIES Other liabilities impact* $1,889 $1,517 $1,841 $2,854 $2,964 STOCKHOLDERS’ EQUITY Cumulative earnings impact $(47,369) $(42,414) $(35,995) $(50,134) $(85,576) Financial Statements Impact of CECL Reserves 40 • Total allowance for credit losses of $85.6 million, of which $2.9 million is related to future funding obligations and recorded in other liabilities. • Loans reported on the balance sheet are net of the allowance for credit losses. ($ in thousands) Q3 2022 Change in provision for credit losses: Loans held-for-investments $(35,331) Other liabilities* $(111) Total provision for credit losses $(35,442) * Represents estimated allowance for credit losses on unfunded loan commitments.

Summary of Investment Portfolio 41 ($ IN MILLIONS) Maximum Loan Commitment Principal Balance Carrying Value Cash Coupon* All-in Yield at Origination* Original Term (Years)* Initial LTV* Stabilized LTV* Senior Loans* $3,914.0 $3,601.3 $3,507.3 L/S + 3.54% L/S+ 4.07% 3.1 66.4% 63.3% Subordinated Loans $13.8 $13.8 $13.1 8.00% 8.11% 10.0 41.4% 36.2% Total Weighted/Average** $3,927.8 $3,615.2 $3,520.4 L +/S + 3. 54% L +/S + 4.07% 3.1 66.3% 63.2% * See definition in this appendix. ** Due to rounding figures may not result in the totals presented.

Investment Portfolio Detail 42 ($ IN MILLIONS) Type* Origination Date Maximum Loan Commitment Principal Balance Carrying Value Cash Coupon* All-in Yield at Origination* Original Term (Years)* State Property Type Initial LTV* Stabilized LTV* Asset 1 Senior 12/15 $120.0 $120.0 $119.9 L + 4.15% L + 4.43% 4.0 LA Mixed-Use 65.5% 60.0% Asset 2 Senior 10/19 120.0 93.0 93.0 L + 3.24% L + 3.86% 3.0 CA Office 63.9% 61.1% Asset 3 Senior 07/18 114.1 114.1 113.7 L + 3.34% L + 4.27% 2.0 CA Retail 50.7% 55.9% Asset 4 Senior 12/19 111.1 106.3 106.0 L + 2.75% L + 3.23% 3.0 IL Multifamily 76.5% 73.0% Asset 5 Senior 12/18 96.4 85.8 85.4 L + 3.75% L + 5.21% 3.0 NY Mixed-Use 26.2% 47.6% Asset 6 Senior 08/19 93.1 93.1 93.2 L + 2.80% L + 3.26% 3.0 MN Office 73.1% 71.2% Asset 7 Senior 07/19 89.9 79.3 79.1 L + 3.69% L + 4.32% 3.0 IL Office 70.0% 64.4% Asset 8 Senior 10/19 87.9 86.6 86.5 L + 2.55% L + 3.05% 3.0 TN Office 70.2% 74.2% Asset 9 Senior 01/20 81.9 70.3 70.2 L + 3.25% L + 3.93% 3.0 CO Industrial 47.2% 47.5% Asset 10 Senior 06/19 81.7 81.4 81.4 L + 2.69% L + 3.05% 3.0 TX Mixed-Use 71.7% 72.2% Asset 11 Senior 10/19 76.8 76.8 76.8 L + 3.36% L + 3.73% 3.0 FL Mixed-Use 67.7% 62.9% Asset 12 Senior 12/16 71.8 69.5 69.5 S + 4.65% S + 4.87% 4.0 FL Office 73.3% 63.2% Asset 13 Senior 11/17 65.7 65.7 65.7 L + 4.45% L + 5.20% 3.0 TX Hotel 68.2% 61.6% Asset 14 Senior 12/19 65.2 59.9 59.8 L + 2.80% L + 3.28% 3.0 NY Office 68.8% 59.3% Asset 15 Senior 07/21 63.3 61.6 61.2 L + 3.00% L + 3.39% 3.0 LA Multifamily 68.8% 68.6% Assets 16-103 Various Various $2,588.9 $2,351.8 $2,341.6 L +/S + 3.63% L +/S + 4.15% 3.2 Various Various 67.6% 63.4% Allowance for Credit Losses $(82.6) Total/Weighted Average $3,927.8 $3,615.2 $3,520.4 L +/S + 3.54% L +/S + 4.07% 3.1 66.3% 63.2% * See definition in this appendix.

Condensed Balance Sheets 43 GRANITE POINT MORTGAGE TRUST INC. CONDENSED CONSOLIDATED BALANCE SHEETS (IN THOUSANDS, EXCEPT SHARE DATA) September 30, 2022 December 31, 2021 ASSETS (unaudited) Loans held-for-investment $ 3,603,016 $ 3,782,205 Allowance for credit losses (82,611) (40,897) Loans held-for-investment, net 3,520,405 3,741,308 Cash and cash equivalents 168,414 191,931 Restricted cash 45,242 12,362 Accrued interest receivable 11,056 10,716 Other assets 37,541 32,201 Total Assets $ 3,782,658 $ 3,988,518 LIABILITIES AND STOCKHOLDERS’ EQUITY Liabilities Repurchase facilities $ 1,195,965 $ 677,285 Securitized debt obligations 1,224,035 1,677,619 Asset-specific financings 44,913 43,622 Term financing facility — 127,145 Convertible senior notes 274,289 272,942 Senior Secured term loan facilities — 139,880 Dividends payable 17,023 14,406 Other liabilities 21,792 21,436 Total Liabilities 2,778,017 2,974,335 Commitments and Contingencies 10% cumulative redeemable preferred stock, par value $0.01 per share; 50,000,000 shares authorized and 1,000 issued and outstanding ($1,000,000 liquidation preference) 1,000 1,000 Stockholders’ Equity 7.00% Series A cumulative redeemable preferred stock, par value $.01 per share; 8,280,000 shares authorized and 8,229,500 and 4,596,500 shares issued and outstanding, respectively; liquidation preference $25.00 per share 82 46 Common stock, par value $0.01 per share; 450,000,000 shares authorized and 52,350,989 and 53,789,465 shares issued and outstanding, respectively 524 538 Additional paid-in capital 1,201,716 1,125,241 Cumulative earnings 136,919 171,518 Cumulative distributions to stockholders (335,725) (284,285) Total Granite Point Mortgage Trust Inc. Stockholders’ Equity 1,003,516 1,013,058 Non-controlling interests 125 125 Total Equity $ 1,003,641 $ 1,013,183 Total Liabilities and Stockholders’ Equity $ 3,782,658 $ 3,988,518

Condensed Statements of Comprehensive Income (Loss) 44 GRANITE POINT MORTGAGE TRUST INC. CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME (in thousands, except share data) Three Months Ended September 30, Nine Months Ended September 30, 2022 2021 2022 2021 Interest income: (unaudited) (unaudited) (unaudited) (unaudited) Loans held-for-investment $ 52,121 $ 48,312 $ 148,475 $ 151,701 Cash and cash equivalents 714 95 960 298 Total interest income 52,835 48,407 149,435 151,999 Interest expense: Repurchase facilities 15,098 5,451 30,486 20,449 Securitized debt obligations 14,416 8,777 34,992 20,523 Convertible senior notes 4,585 4,556 13,703 13,618 Term financing facility — 1,453 1,713 6,208 Asset-specific financings 442 414 1,046 1,959 Senior secured term loan facilities — 5,654 3,754 16,587 Total Interest Expense 34,541 26,305 85,694 79,344 Net interest income 18,294 22,102 63,741 72,655 Other (loss) income: (Provision for) Benefit from credit losses (35,442) 5,760 (52,757) 15,072 Loss on extinguishment of debt — — (18,823) — Fee income — — 954 — Total other (loss) income (35,442) 5,760 (70,626) 15,072 Expenses: Compensation and benefits 4,953 5,634 16,539 16,111 Servicing expenses 1,336 1.323 4,297 3,763 Other operating expenses 2,068 2,276 6,867 6,967 Total expenses 8,357 9,233 27,703 26,841 (Loss) income before income taxes (25,505) 18,629 (34,588) 60,886 Provision for (benefit from) income taxes (1) (1) 11 (4) Net (loss) income (25,504) 18,630 (34,599) 60,890 Dividends on preferred stock 3,626 25 10,876 75 Net (loss) income attributable to common stockholders $ (29,130) $ 18,605 $ (45,475) $ 60,815 Basic (loss) earnings per weighted average common share $ (0.56) $ 0.34 $ (0.85) $ 1.11 Diluted (loss) earnings per weighted average common share $ (0.56) $ 0.33 $ (0.85) $ 1.05 Dividends declared per common share $ 0.25 $ 0.25 $ 0.75 $ 0.75 Weighted average number of shares of common stock outstanding: Basic 52,350,989 54,453,546 53,234,498 54,864,456 Diluted 52,350,989 56,735,278 53,234,498 70,902,745 Comprehensive (loss) income: Comprehensive (loss) income $ (29,130) $ 18,605 $ (45,475) $ 60,815

▪ Beginning with our Annual Report on Form 10-K for the year ended December 31, 2021, and for all subsequent reporting periods ending on or after December 31, 2021, we have elected to present Distributable Earnings, a measure that is not prepared in accordance with GAAP, as a supplemental method of evaluating our operating performance. Distributable Earnings replaces our prior presentation of Core Earnings with no changes to the definition. In order to maintain our status as a REIT, we are required to distribute at least 90% of our taxable income as dividends. Distributable Earnings is intended to over time serve as a general, though imperfect, proxy for our taxable income. As such, Distributable Earnings is considered a key indicator of our ability to generate sufficient income to pay our common dividends, which is the primary focus of income-oriented investors who comprise a meaningful segment of our stockholder base. We believe providing Distributable Earnings on a supplemental basis to our net income and cash flow from operating activities, as determined in accordance with GAAP, is helpful to stockholders in assessing the overall run-rate operating performance of our business. ▪ We use Distributable Earnings to evaluate our performance, excluding the effects of certain transactions and GAAP adjustments we believe are not necessarily indicative of our current loan portfolio and operations. For reporting purposes, we define Distributable Earnings as net income attributable to our stockholders, computed in accordance with GAAP, excluding: (i) non-cash equity compensation expenses; (ii) depreciation and amortization; (iii) any unrealized gains (losses) or other similar non-cash items that are included in net income for the applicable reporting period (regardless of whether such items are included in other comprehensive income or in net income for such period); and (iv) certain non-cash items and one-time expenses. Distributable Earnings may also be adjusted from time to time for reporting purposes to exclude one-time events pursuant to changes in GAAP and certain other material non-cash income or expense items approved by a majority of our independent directors. The exclusion of depreciation and amortization from the calculation of Distributable Earnings only applies to debt investments related to real estate to the extent we foreclose upon the property or properties underlying such debt investments. Distributable Earnings 45

▪ While Distributable Earnings excludes the impact of the unrealized non-cash current provision for credit losses, we expect to only recognize such potential credit losses in Distributable Earnings if and when such amounts are deemed non-recoverable. This is generally at the time a loan is repaid, or in the case of foreclosure, when the underlying asset is sold, but nonrecoverability may also be concluded if, in our determination, it is nearly certain that all amounts due will not be collected. The realized loss amount reflected in Distributable Earnings will equal the difference between the cash received, or expected to be received, and the carrying value of the asset, and is reflective of our economic experience as it relates to the ultimate realization of the loan. During the three and nine months ended September 30, 2022, we recorded provision for credit losses of $(35.4) million and $(52.8) million, respectively, which has been excluded from Distributable Earnings consistent with other unrealized gains (losses) and other non- cash items pursuant to our existing policy for reporting Distributable Earnings. Pursuant to our existing policy for reporting Distributable Earnings, during the nine months ended September 30, 2022, we recorded a $0.5 million recovery of amounts previously written off in a prior period on a discounted payoff. Additionally, during the nine months ended September 30, 2022, we recorded a $(10.1) million write-off on a loan sale, which we included in Distributable Earnings because we did not collect all amounts due at the time the loan was sold. During the nine months ended September 30, 2022, we recorded a $(18.8) million, loss on early extinguishment of debt, which has been excluded from Distributable Earnings consistent with certain one-time expenses pursuant to our existing policy for reporting Distributable Earnings as a helpful indicator in assessing the overall run-rate operating performance of our business. ▪ Distributable Earnings does not represent net income or cash flow from operating activities and should not be considered as an alternative to GAAP net income, or an indication of our GAAP cash flows from operations, a measure of our liquidity, or an indication of funds available for our cash needs. In addition, our methodology for calculating Distributable Earnings may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures, and, accordingly, our reported Distributable Earnings may not be comparable to the Distributable Earnings reported by other companies. Distributable Earnings (cont’d) 46

Other Definitions 47 All-in Yield at Origination ▪ Provided for illustrative purposes only. Calculations of all-in yield at origination are based on a number of assumptions (some or all of which may not occur) and are expressed as monthly equivalent yields that include net origination fees and exit fees and exclude future fundings and any potential or completed loan amendments or modifications. Calculations of all-in weighted average yield at origination exclude fixed rate loans. Cash Coupon ▪ Cash coupon does not include origination or exit fees. Future Fundings ▪ Fundings to borrowers of loan principal balances under existing commitments on our loan portfolio. Initial LTV ▪ The initial loan amount (plus any financing that is pari passu with or senior to such loan) divided by the as is appraised value (as determined in conformance with USPAP) as of the date the loan was originated set forth in the original appraisal. Net Income Attributable to Common Stockholders ▪ GAAP net income (loss) attributable to our common stockholders after deducting dividends attributable to our cumulative redeemable preferred stock. Non — MTM ▪ Non-Mark-to-Market. Original Term (Years) ▪ The initial maturity date at origination and does not include any extension options and has not been updated to reflect any subsequent extensions or modifications, if applicable. Pre-Provision, Pre-Loss Earnings ▪ Net interest income, less operating expenses and provision for income taxes. Recourse Leverage ▪ Borrowings outstanding on repurchase facilities, asset-specific financings, convertible senior notes and senior secured term loan facilities, less cash, divided by total stockholders’ equity. Senior Loans ▪ “Senior” means a loan primarily secured by a first priority lien on commercial real property and related personal property and also includes, when applicable, any companion subordinate loans.

Other Definitions (cont’d) 48 Stabilized LTV ▪ The fully funded loan amount (plus any financing that is pari passu with or senior to such loan), including all contractually provided for future fundings, divided by the as stabilized value (as determined in conformance with USPAP) set forth in the original appraisal. As stabilized value may be based on certain assumptions, such as future construction completion, projected re-tenanting, payment of tenant improvement or leasing commissions allowances or free or abated rent periods, or increased tenant occupancies. Total Leverage ▪ Borrowings outstanding on repurchase facilities, securitized debt obligations, asset-specific financings, convertible senior notes and senior secured term loan facilities, less cash, divided by total stockholders’ equity. Wtd. Avg Coupon ▪ Does not include fees and other transaction related expenses.

Company Information 49 Granite Point Mortgage Trust Inc. is an internally-managed real estate finance company that focuses primarily on directly originating, investing in and managing senior floating rate commercial mortgage loans and other debt and debt-like commercial real estate investments. Granite Point was incorporated in Maryland on April 7, 2017, and has elected to be treated as a real estate investment trust for U.S. federal income tax purposes. For more information regarding Granite Point, visit www.gpmtreit.com. Contact Information: Corporate Headquarters: 3 Bryant Park, 24th Floor New York, NY 10036 212-364-5500 New York Stock Exchange: Symbol: GPMT Investor Relations: Marcin Urbaszek Chief Financial Officer 212-364-5500 Investors@gpmtreit.com Transfer Agent: Equiniti Trust Company P.0. Box 64856 St. Paul, MN 55164-0856 800-468-9716 www.shareowneronline.com Credit Suisse Douglas Harter (212) 538-5983 JMP Securities Steven DeLaney (212) 906-3517 Keefe, Bruyette & Woods Jade Rahmani (212) 887-3882 Raymond James Stephen Laws (901) 579-4868 Analyst Coverage:* * No report of any analyst is incorporated by reference herein and any such report represents the sole views of such analyst.